Nibble introduces new investment Strategy — Legal

2 min to read PrintFrom now on, a new investment strategy is available to our investors, featuring a high and predictable return of up to 14.5% per annum and a deposit back guarantee.

Also, in order to maintain profitability in the current market situation and the requirements of the regulator, we update interest rates for the new portfolios of the Classic and Balanced strategies. Rates for existing portfolios do not change.

Classic — 8% per annum

Balanced — 12,5% per annum

About the product

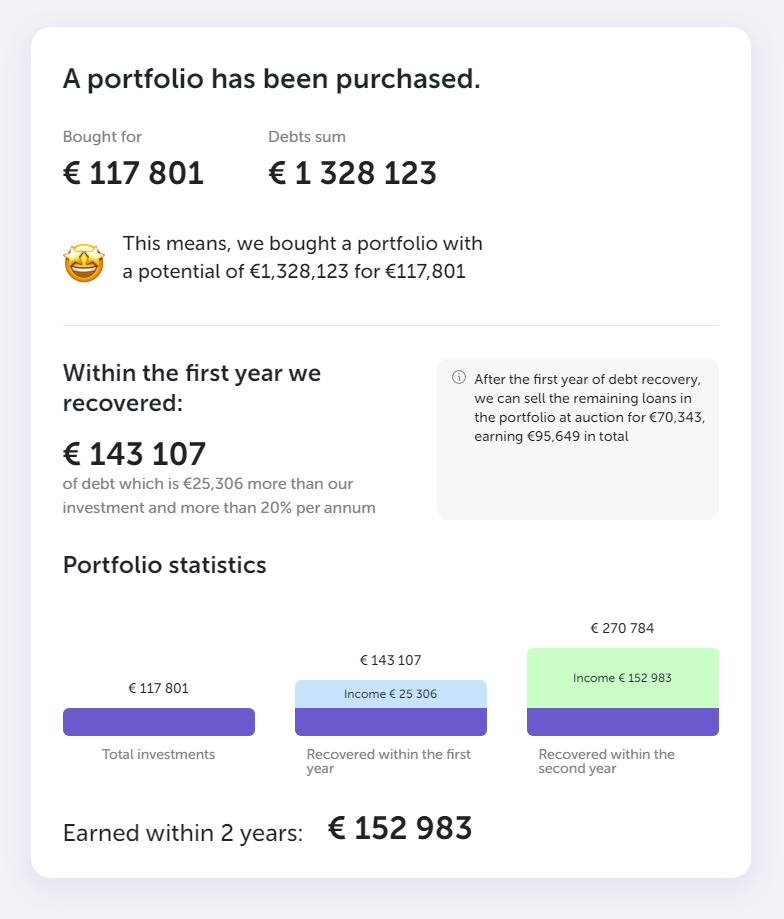

Any financial company specializing in lending inevitably faces loans that are not repaid within the terms specified in the contract. Many companies sell such loans in large portfolios at auctions with 85% discount, in order to quickly return a part of the money to the business.

Boostr buys such portfolios at auctions.

Thanks to the deep experience and technologies developed by Boostr, it is possible to achieve a high percentage of capital return. In Eurasia the company has more than 5 years of experience and more than 80 employees.

In Europe Boostr works in partnership with collection agencies, who specialize on the debt recovery of European loans.

Since 2019, auction platforms for the sale of debts, such as Debex and NLPBroker, have begun to actively appear on the Spanish market, which shows the growth of the market. Also there are many other collection agenies on the market specializing in debt recovery. According to information provided by our partners from this industry with more then 25 years of experience, the investor's return can reach up to 19% per annum.

Historical profitability

Based on this business, we have developed a Legal Strategy.

This is a strategy for investing in portfolios consisting of consumer loans classified as B, CC and C, which are in the process of pre-trial and judicial recovery. Due to the fact that these loans have overdue debts and fines, the yield of this strategy reaches up to 19% per annum.

The litigation and recovery process takes a long period of time, so the minimum investment period is 8 months.

Associated risks:

Risk of non-repayment of the loan/default of the entire loan amount

- The strategy comes with the deposit back guarantee – this is the obligation of the collection agency to return the full investment amount at the end of the investment period and ensure a minimum yield of 8% per annum.

- Due to investment into a portfolio consisting of a large number of loans, the risk of not receiving income from several contracts is reduced as they are covered by other loans.

- Daily interest accrual at 8% per annum, payouts every 90 days according to the actual received yield up to 14.5% per annum.

- During the fundraising process for a portfolio purchase, we accrue income at 8% per annum. This is your bonus yield to the main one that goes up to 14.5%. The maximum term for fundraising to purchase a portfolio is 30 days.

How does it work?

You choose a portfolio according to your preferences and invest in it. While the portfolio is in the fundraising process, you daily receive an interest of 8% per annum. After the end of the process, you also receive daily interest at a rate of 8% per annum and every 90 days, we automatically calculate the actual yield of portfolios and grant you the difference between the guaranteed rate of 8% and the actual rate of up to 14.5%. Thus, every 90 days you receive an income ranging between 8% and 14.5% onto your Nibble account.

Example: By investing 1000 euro for 12 months, at the end of the term you get back your entire capital of 1000 euro and receive an income between 80 and 145 euro, which will be added straight onto your Nibble account.

How we make money for investors:

- Boostr buys overdue loans from banks and MFOs at auctions, with a discount of 85%.

- The pre-trial process begins, when the agency contacts the borrower and tries to agree on the return of the debt.

- If it was not possible find a solution, then the process of court proceedings begins to obtain a court decision on the debt collection from the debtor, which is managed by Boostr or its partner.

- After receiving a judicial order, debt, interest, and fines are collected through the bailiff services and banks.

en

en es

es de

de it

it